Make a group of 10 people having same characteristics e.g. Age, Gender, Intelligence, Education & Common Sense. Teach them a business & give them $1 Million each. Now ask them to go out & start the business.

Check & compare all of them after 5 – 10 years. Do you think every one would have same amount of money or everyone would be equally successful? If not then why not?

Now apply the same question in Trading:

Make of group of 10 people (who don’t know anything about trading) having same characteristics e.g. Age, Gender, Intelligence, Education & Common Sense. Teach them how to trade with same techniques, provide them same tools & give them $1 Million each. Now ask them to go out & start trading.

Check & compare all of them with each other. Would they all be profitable? If not why not?

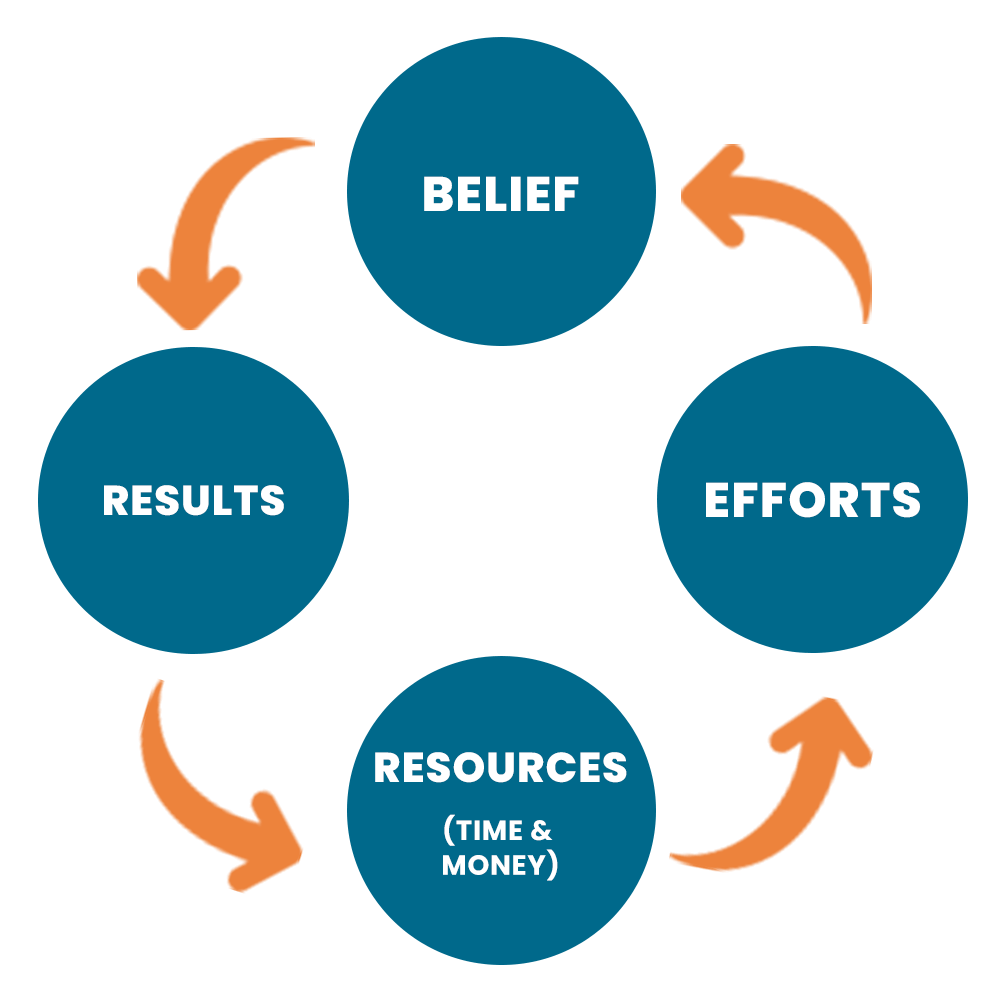

So what is important for Success?

Make a group of 10 people having same characteristics e.g. Age, Gender, Intelligence, Education & Common Sense. Teach them a business & give them $1 Million each. Now ask them to go out & start the business.

Check & compare all of them after 5 – 10 years. Do you think every one would have same amount of money or everyone would be equally successful? If not then why not?

Now apply the same question in Trading:

Make of group of 10 people (who don’t know anything about trading) having same characteristics e.g. Age, Gender, Intelligence, Education & Common Sense. Teach them how to trade with same techniques, provide them same tools & give them $1 Million each. Now ask them to go out & start trading.

Check & compare all of them with each other. Would they all be profitable? If not why not?

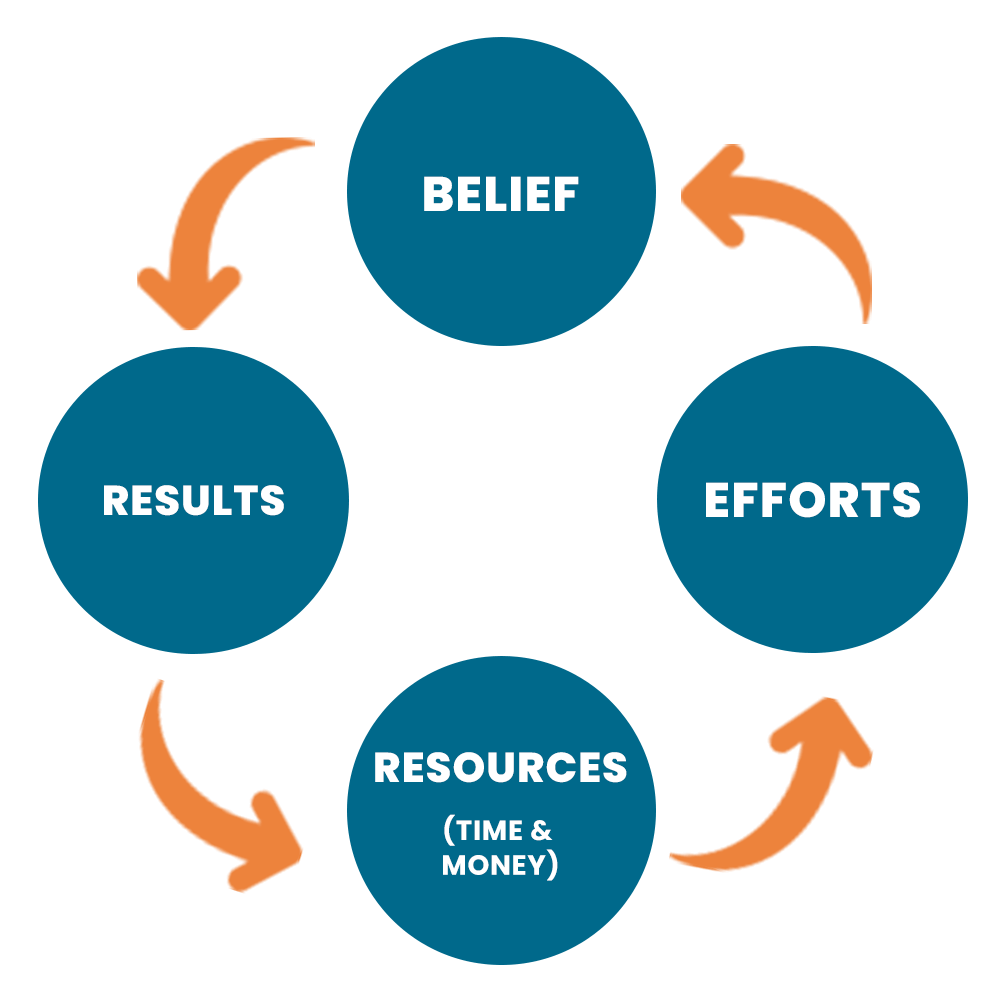

So what is important for Success?

Now ask another question to yourself & I need an honest answer to this question.

Do you think you can ever be as rich as Bill Gates is OR more than him?

Yes or No

Now ask another question to yourself & I need an honest answer to this question.

Do you think you can ever be as rich as Bill Gates is OR more than him?

Yes or No

Elephants are used to transportations of heavy good/stuff in Thailand. These elephants always obeys their master orders. The most amazing fact is that once they finish their day job, they are tied with a chain or rope which is relatively many times weaker than the size & strength of that elephant.

Now another question … how come that weak chain or rope makes that elephant tied all the night?

The answer is Psychology. How? Let me explain.

When they want to train an elephant, they get a baby elephant. They tie him with a chain which is relatively stronger than this little baby. This baby elephant tries to break the chain over & over again for many days until his little mind tells him that this chain is much stronger than his strength so he would not be able to break that chain. With this frame of mind this baby elephant gives up one day.

Even after few years (when he grow up & become a much stronger giant) he still has same thinking that this chain is much stronger than me so he never tries to break that chain. So what makes him to remain tied with that weaker chain? It’s the way he think. Not the chain.

“If you born poor, it’s not your mistake but if you die poor then it’s your mistake”.

“Before leaving university my teachers told me that you only can be a truck driver, and then I started a company & employed my University Toppers”.

Bill Gates

The moral of his quotes is:

“Never let anyone tell you that you can’t do it. If someone tells you that you can’t do it, it actually mean he/she is telling you that he/she himself/herself can’t do it NOT you”.

Elephants are used to transportations of heavy good/stuff in Thailand. These elephants always obeys their master orders. The most amazing fact is that once they finish their day job, they are tied with a chain or rope which is relatively many times weaker than the size & strength of that elephant.

Now another question … how come that weak chain or rope makes that elephant tied all the night?

The answer is Psychology. How? Let me explain.

When they want to train an elephant, they get a baby elephant. They tie him with a chain which is relatively stronger than this little baby. This baby elephant tries to break the chain over & over again for many days until his little mind tells him that this chain is much stronger than his strength so he would not be able to break that chain. With this frame of mind this baby elephant gives up one day.

Even after few years (when he grow up & become a much stronger giant) he still has same thinking that this chain is much stronger than me so he never tries to break that chain. So what makes him to remain tied with that weaker chain? It’s the way he think. Not the chain.

“If you born poor, it’s not your mistake but if you die poor then it’s your mistake”.

“Before leaving university my teachers told me that you only can be a truck driver, and then I started a company & employed my University Toppers”.

Bill Gates

The moral of his quotes is:

“Never let anyone tell you that you can’t do it. If someone tells you that you can’t do it, it actually mean he/she is telling you that he/she himself/herself can’t do it NOT you”.

Have you ever realized that our lives are full of decisions & actions which we never planned but some how we managed to do?

Imagine:

Have you ever realized that our lives are full of decisions & actions which we never planned but some how we managed to do?

Imagine:

Sub-conscious mind is a part of brain which is responsible for these unplanned & sudden actions/activities. Its basic function is storing memories which often comes as dream while we are sleeping.

Our sub-conscious mind never sleeps so it remains active while we are sleeping. In day time when our conscious mind is more active than sub-conscious mind, our sub-conscious mind overrides the conscious mind to perform these unplanned & sudden action/activities.

GREED & FEAR are two state of our mind which drives out all the logics from our brain. These conditions are the main reasons why trader loose money in trading. Large players makes lots of money by creating these two states in retail traders. Even in real life using these two state once can manipulate others in a way he/she wants to them to react. These states are performed by our Sub-Conscious mind.

Surprisingly, this part of brain can be programmed to root out the GREED & FEAR to achieve an ideal mental state from trading.

Sub-conscious mind is a part of brain which is responsible for these unplanned & sudden actions/activities. Its basic function is storing memories which often comes as dream while we are sleeping.

Our sub-conscious mind never sleeps so it remains active while we are sleeping. In day time when our conscious mind is more active than sub-conscious mind, our sub-conscious mind overrides the conscious mind to perform these unplanned & sudden action/activities.

GREED & FEAR are two state of our mind which drives out all the logics from our brain. These conditions are the main reasons why trader loose money in trading. Large players makes lots of money by creating these two states in retail traders. Even in real life using these two state once can manipulate others in a way he/she wants to them to react. These states are performed by our Sub-Conscious mind.

Surprisingly, this part of brain can be programmed to root out the GREED & FEAR to achieve an ideal mental state from trading.

Neuro-linguistic programming (NLP) is an approach to communication, personal development, and psychotherapy created by Richard Bandler and John Grinder in California, United States in the 1970s.

Self-hypnosis is a NLP technique to program our subconscious mind in a way we want it to react. Meditation & Self-suggestion using a mirror are more effective ways to perform it.

You can try it out & experience its magic. When you are on your bed just before you fall in sleep, speak to your self three times by calling your name that “ (your name) please awake me up at 6 O clock in the morning”. In morning around 6 O clock, you would feel that somebody awoke you up, who was it? It was your sub-conscious mind who did as you instructed him.

How does it benefit us in trading?

Using self-hypnosis we can program our sub-conscious mind to take out GREED & FEAR and acting with the mentality professionals trader have.

Neuro-linguistic programming (NLP) is an approach to communication, personal development, and psychotherapy created by Richard Bandler and John Grinder in California, United States in the 1970s.

Self-hypnosis is a NLP technique to program our subconscious mind in a way we want it to react. Meditation & Self-suggestion using a mirror are more effective ways to perform it.

You can try it out & experience its magic. When you are on your bed just before you fall in sleep, speak to your self three times by calling your name that “ (your name) please awake me up at 6 O clock in the morning”. In morning around 6 O clock, you would feel that somebody awoke you up, who was it? It was your sub-conscious mind who did as you instructed him.

How does it benefit us in trading?

Using self-hypnosis we can program our sub-conscious mind to take out GREED & FEAR and acting with the mentality professionals trader have.

By standing in front of mirror, looking in your own eyes, assuming the reflection as your sub-conscious mind. You should repeat following facts three times daily. This will start programming your sub-conscious mind.

By standing in front of mirror, looking in your own eyes, assuming the reflection as your sub-conscious mind. You should repeat following facts three times daily. This will start programming your sub-conscious mind.