Its a decentralized global market where all the world’s currencies are traded. The forex market is the most liquid & the largest market in the world with an average daily trading volume around $5 trillion. All the world’s combined stock markets doesn’t even come close to this.

Its a decentralized global market where all the world’s currencies are traded. The forex market is the most liquid & the largest market in the world with an average daily trading volume around $5 trillion. All the world’s combined stock markets doesn’t even come close to this.

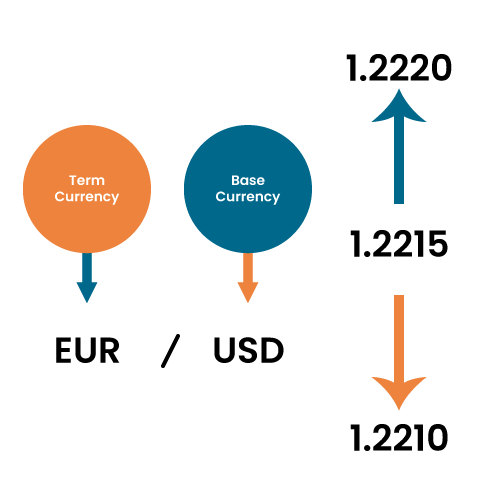

A PIP which stands for “percentage in point” is the smallest price movement in a currency pair. It’s usually represented by the fourth decimal place such as 0.0001.

Pips are crucial because they help traders measure price changes and determine potential profits or losses.

Understanding pips is essential for accurately assessing the potential gains from a trade.

A PIP which stands for “percentage in point” is the smallest price movement in a currency pair. It’s usually represented by the fourth decimal place such as 0.0001.

Pips are crucial because they help traders measure price changes and determine potential profits or losses.

Understanding pips is essential for accurately assessing the potential gains from a trade.

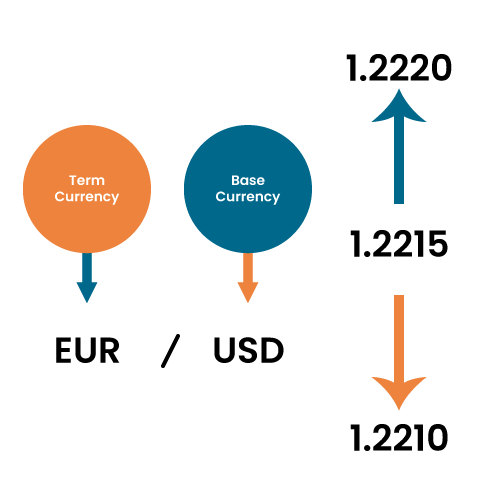

The spread in forex trading refers to the difference between the buying (ask) price and the selling (bid) price of a currency pair.

Essentially, it’s the cost of the trade and serves as a source of profit for brokers.

A narrower spread is generally more favorable for traders, as it means lower transaction costs and a quicker break-even point.

The spread in forex trading refers to the difference between the buying (ask) price and the selling (bid) price of a currency pair.

Essentially, it’s the cost of the trade and serves as a source of profit for brokers.

A narrower spread is generally more favorable for traders, as it means lower transaction costs and a quicker break-even point.

Margin is the collateral required to open and maintain a trading position. It’s a small percentage of the total trade value, allowing traders to control larger positions with a relatively small investment.

While margin trading can amplify potential returns, it also exposes traders to greater risk, as losses can exceed the initial margin.

Margin is the collateral required to open and maintain a trading position.

It’s a small percentage of the total trade value, allowing traders to control larger positions with a relatively small investment.

While margin trading can amplify potential returns, it also exposes traders to greater risk, as losses can exceed the initial margin.

Leverage is the ability to control a larger trading position with a smaller amount of capital.

It’s often expressed as a ratio, like 1:50 or 1:200, indicating how much larger the trade size is compared to the margin required.

Leverage can amplify profits, but it also increases the potential for substantial losses.

Traders should exercise caution and have a clear understanding of the risks involved.

Leverage is the ability to control a larger trading position with a smaller amount of capital.

It’s often expressed as a ratio, like 1:50 or 1:200, indicating how much larger the trade size is compared to the margin required.

Leverage can amplify profits, but it also increases the potential for substantial losses. Traders should exercise caution and have a clear understanding of the risks involved.