Economic Fundamentals is just another name of study of the economies of the countries who’s currencies are being traded in forex trading. It also includes the analyzing the economic news (figures released by different departments within a country) which may have lesser/greater impact on current economic situation of a country in question. Summary, scheduled time, forecasts & outcomes of these economic news is available on different economic calendars available online on different websites (e.g. forex factory & dailyfx etc.)

Markets moves on Economic Fundamentals.

Often these information are embedded in Technical, up to some extent.

But having strong knowledge about Economic Fundamentals gives you a definite edge over those traders who just use Technical Analysis for forex trading.

Economic Fundamentals is just another name of study of the economies of the countries who’s currencies are being traded in forex trading. It also includes the analyzing the economic news (figures released by different departments within a country) which may have lesser/greater impact on current economic situation of a country in question. Summary, scheduled time, forecasts & outcomes of these economic news is available on different economic calendars available online on different websites (e.g. forex factory & dailyfx etc.)

Markets moves on Economic Fundamentals.

Often these information are embedded in Technical, up to some extent.

But having strong knowledge about Economic Fundamentals gives you a definite edge over those traders who just use Technical Analysis for forex trading.

Often News Spike Trading is taken as Fundamental Trading but there is significant difference in between.

News Spike Trading is a method/strategy to catch the price action spike after high impact news/figures release. This method/strategy is too risky & often cause uncontrolled losses. High Frequency Trading Systems/Algorithmic trading cause price to move with lightening speed. Just moments before figures releases, market makers or liquidity providers remove the liquidity to hedge their exposure which cause excessive slippage. This situation makes it nearly impossible for retail traders to make money consistently using this method/strategy.

On other side Fundamental Trading is an approach to take an intraday/swing position in the direction of overall economic picture created by these economic indicators as discussed in this webinar. These position usually keeps running until a counter economic picture is created or price hits a strong level of support or resistance.

Often News Spike Trading is taken as Fundamental Trading but there is significant difference in between.

News Spike Trading is a method/strategy to catch the price action spike after high impact news/figures release. This method/strategy is too risky & often cause uncontrolled losses. High Frequency Trading Systems/Algorithmic trading cause price to move with lightening speed. Just moments before figures releases, market makers or liquidity providers remove the liquidity to hedge their exposure which cause excessive slippage. This situation makes it nearly impossible for retail traders to make money consistently using this method/strategy.

On other side Fundamental Trading is an approach to take an intraday/swing position in the direction of overall economic picture created by these economic indicators as discussed in this webinar. These position usually keeps running until a counter economic picture is created or price hits a strong level of support or resistance.

• Fiscal policy

• Fiscal policy is the means by which a government adjusts its spending levels and tax rates to monitor and influence a nation’s economy. It is the sister strategy to monetary policy.

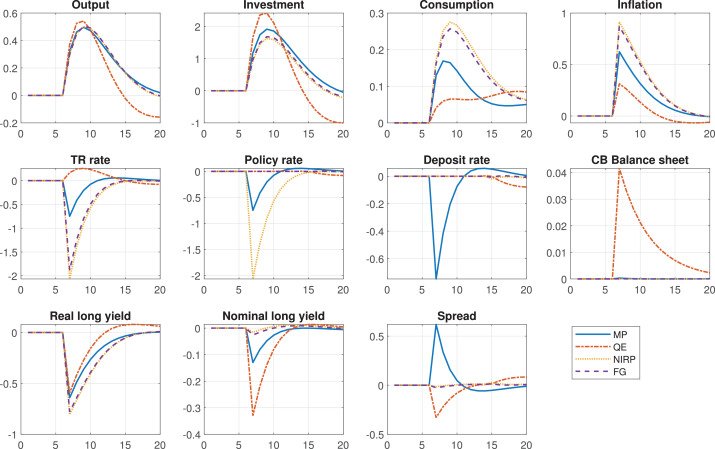

• Monetary policy

• Monetary policy consists of the actions of a central bank, currency board or other regulatory committee that determine the size and rate of growth of the money supply, which in turn affects interest rates. Monetary policy is maintained through actions such as modifying the interest rate, buying or selling government bonds, and changing the amount of money banks are required to keep in the vault (bank reserves).

• Fiscal policy

• Fiscal policy is the means by which a government adjusts its spending levels and tax rates to monitor and influence a nation’s economy. It is the sister strategy to monetary policy.

• Monetary policy

• Monetary policy consists of the actions of a central bank, currency board or other regulatory committee that determine the size and rate of growth of the money supply, which in turn affects interest rates. Monetary policy is maintained through actions such as modifying the interest rate, buying or selling government bonds, and changing the amount of money banks are required to keep in the vault (bank reserves).

Central bank monitors the KPI’s (key performance economic indicators) mainly in following 3 categories.

• Inflation • Employment • Growth

Central bank monitors the KPI’s (key performance economic indicators) mainly in following 3 categories.

• Inflation • Employment • Growth

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, in following categories:

• Food and beverages • energy

• Housing

• Apparel (Clothing)

• Transportation

• Medical care

• Recreation (enjoyment)

• Education and communication • Other goods and services

It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. Changes in the CPI are used to assess price changes associated with the cost of living; the CPI is one of the most frequently used statistics for identifying periods of inflation or deflation.

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, in following categories:

• Food and beverages • energy

• Housing

• Apparel (Clothing)

• Transportation

• Medical care

• Recreation (enjoyment)

• Education and communication • Other goods and services

It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. Changes in the CPI are used to assess price changes associated with the cost of living; the CPI is one of the most frequently used statistics for identifying periods of inflation or deflation.

Low savings

Low interest rates (not good for investors & savers)

Money transfer from Saver & Investors to Debtors: (it becomes easier for debtors to pay their debts as inflation reduces the interest rate, if its more than interest rate then chunk of loan get paid without doing anything).

Inefficient Government Spending: (History shows that they spend it inefficiently when they get easily printed money, but when they get via taxes they are accountable up to some extent.)

Mal-investments: (The investment you make to acquire an asset become less which needs more money to acquire what you could have done with less money before inflation).

Higher Taxes: (if government doesn’t adjust Tax brackets then increase in your income due to inflation (only in number, not in real) pushes you to higher tax brackets so you pay more taxes).

Low savings

Low interest rates (not good for investors & savers)

Money transfer from Saver & Investors to Debtors: (it becomes easier for debtors to pay their debts as inflation reduces the interest rate, if its more than interest rate then chunk of loan get paid without doing anything).

Inefficient Government Spending: (History shows that they spend it inefficiently when they get easily printed money, but when they get via taxes they are accountable up to some extent.)

Mal-investments: (The investment you make to acquire an asset become less which needs more money to acquire what you could have done with less money before inflation).

Higher Taxes: (if government doesn’t adjust Tax brackets then increase in your income due to inflation (only in number, not in real) pushes you to higher tax brackets so you pay more taxes).

Quantitative easing exit or quantitative easing tapering (QE exit/ QE tapering)

Interest rate hike

Quantitative easing exit or quantitative easing tapering (QE exit/ QE tapering)

Interest rate hike